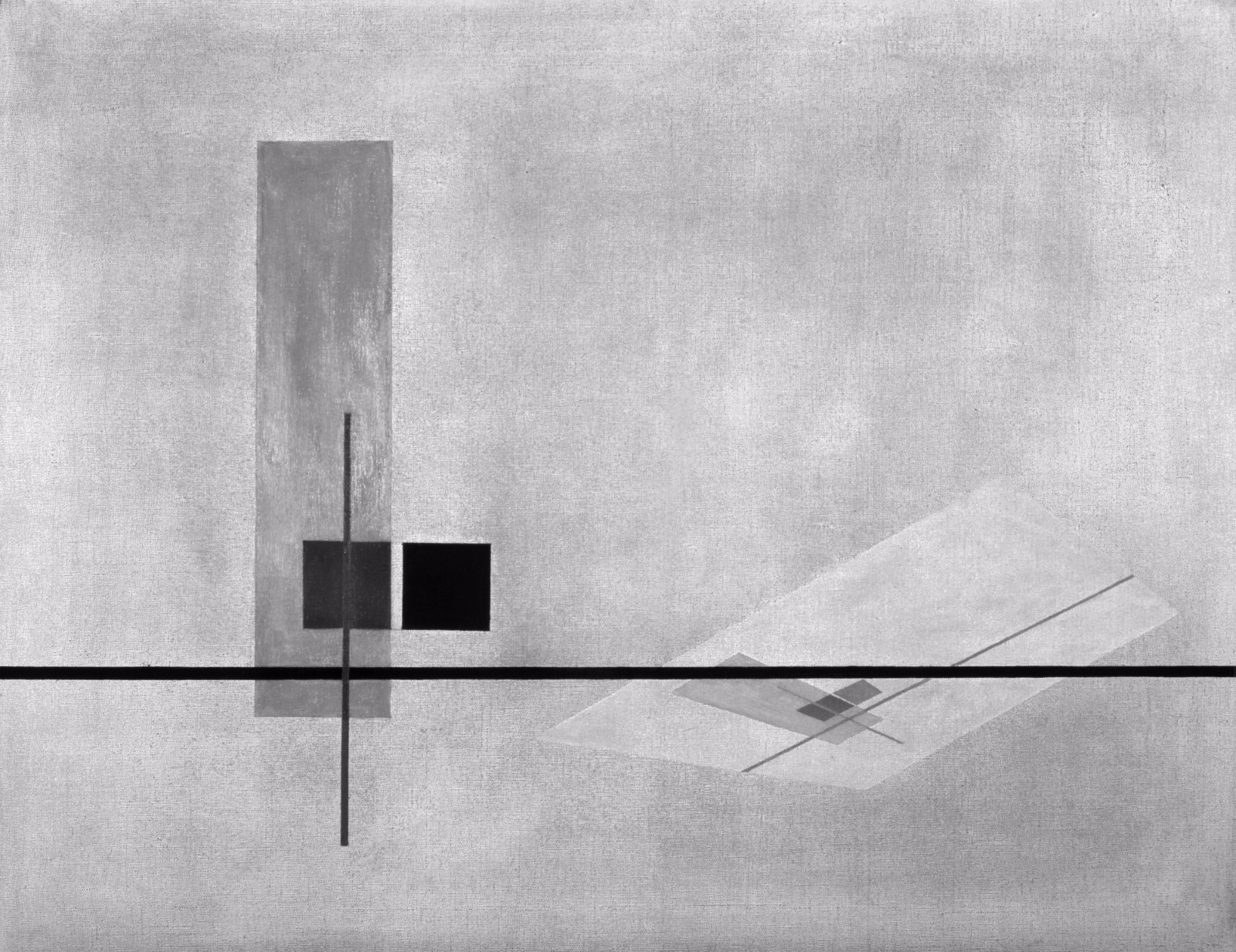

seeing the artist in the entrepreneur

Our mission is to support entrepreneurs with a superb global vision in turning their ideas into success.

How do we do this?

We turn your ideas into solid business plans.

We organize the necessary funding to roll out your plan.

We help building successful and effective organisations.

Team

References

We prefer other people telling you what we can do for you,

so please do not hesitate to call for a reference.

Who are we

looking for?

The entrepreneur who besides being innovative, inspirational, passionate and creative is also stubborn, difficult or egocentric, but smart enough to ask for help when needed.

What are you

looking for?

Some calm, solid organizers who can support you in making the right choices at the right time by challenging a plan, creating focus and clear targets and if needed provide hands-on help.